QuantLedger Review: A Smarter Way to Manage Your Crypto & Financial Data

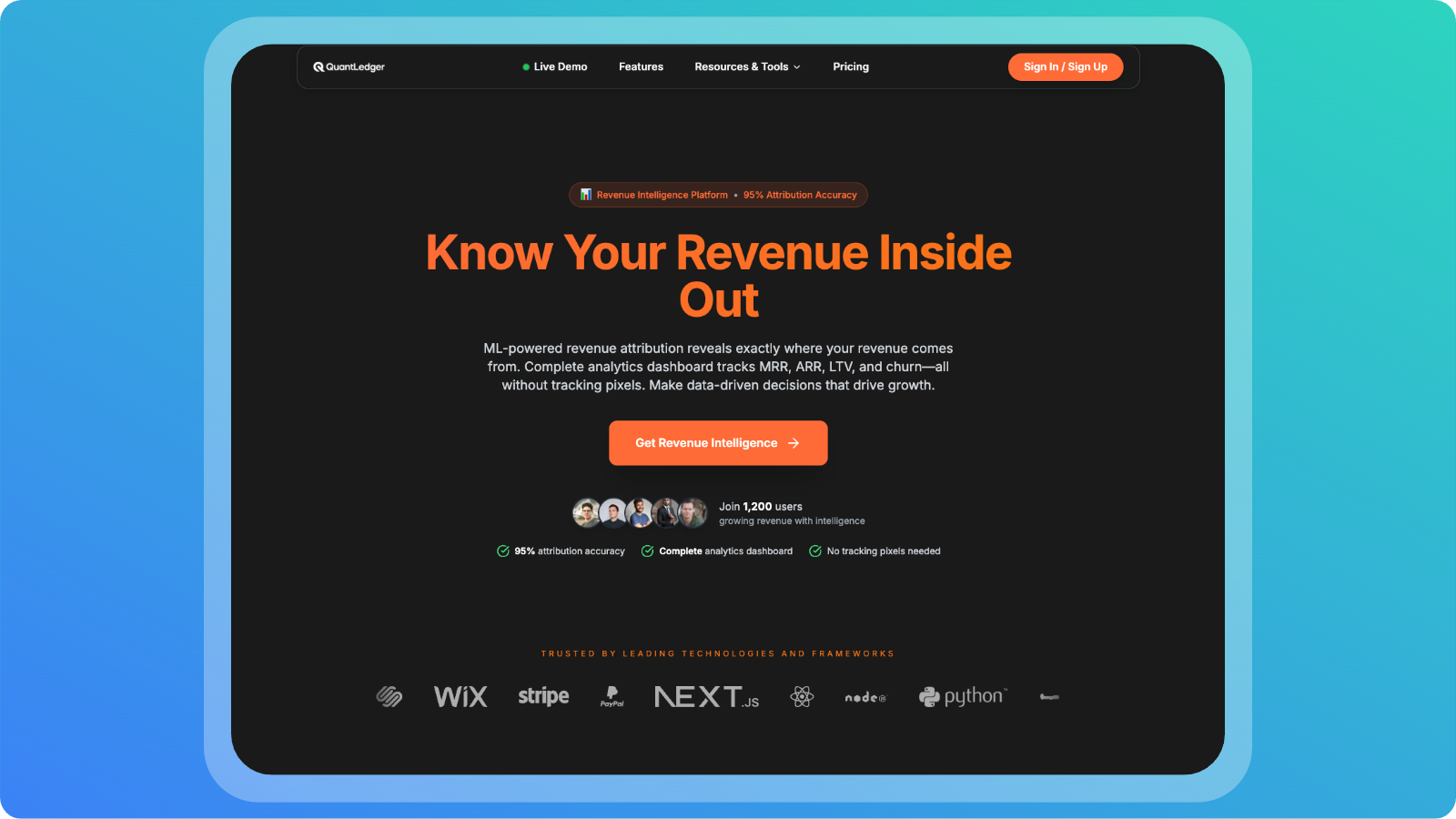

Know Your Revenue Inside Out

Posted by

Related reading

NanoPhoto AI Review: Where Artistic Vision Meets AI Brilliance

AI makes video and photo editing simple

Visualizee.ai Review: Is This the Best AI Design Tool for Your Creative Needs in 2025?

Discover Visualizee.ai's features, pricing, and performance in this co...

Post Everywhere Review: Is AI Marketing Automation the Future for Your Social Media Strategy?

Discover how Post Everywhere's AI marketing automation tools can eleva...

Get your own Review

Let us try and review your product.

- ●Rank on "[your_product] review" on Google and earn a strong backlink

- ●Private feedback from our team to improve your product

- ●Strengthen your customer trust

Introduction

Navigating the finance and crypto world can get overwhelming fast, especially when juggling multiple assets, wallets, and metrics that need constant tracking. QuantLedger caught my attention as a tool promising to clean up that chaos by acting as your intelligent, all-in-one financial command center. After spending time with it, it’s clear this platform is built for people who don’t just hold assets, they actively analyze them.

What is QuantLedger

QuantLedger combines AI driven insights with traditional financial analytics, meaning you're not just looking at past performance but getting a predictive view of where your portfolio might be heading. Instead of spreadsheets, endless wallet trackers, and manual dashboards, QuantLedger automates the heavy lifting

Here’s what it brings to the table:

- Transaction Tracking: automatically logs and categorizes every move

- Portfolio Management: organizes assets across wallets and exchanges

- Financial Reporting: detailed reports for performance, income, and spending

- AI Powered Insights: forecasts and behavior based predictions

- Strategy Tools: assists in planning investment and trading moves

Churn Risk + Revenue Modeling (for crypto businesses/SaaS) ML Attribution with 95% accuracy, without pixel tracking

Whether you're actively trading, managing long-term investments, or advising clients, these insights can make a measurable difference.

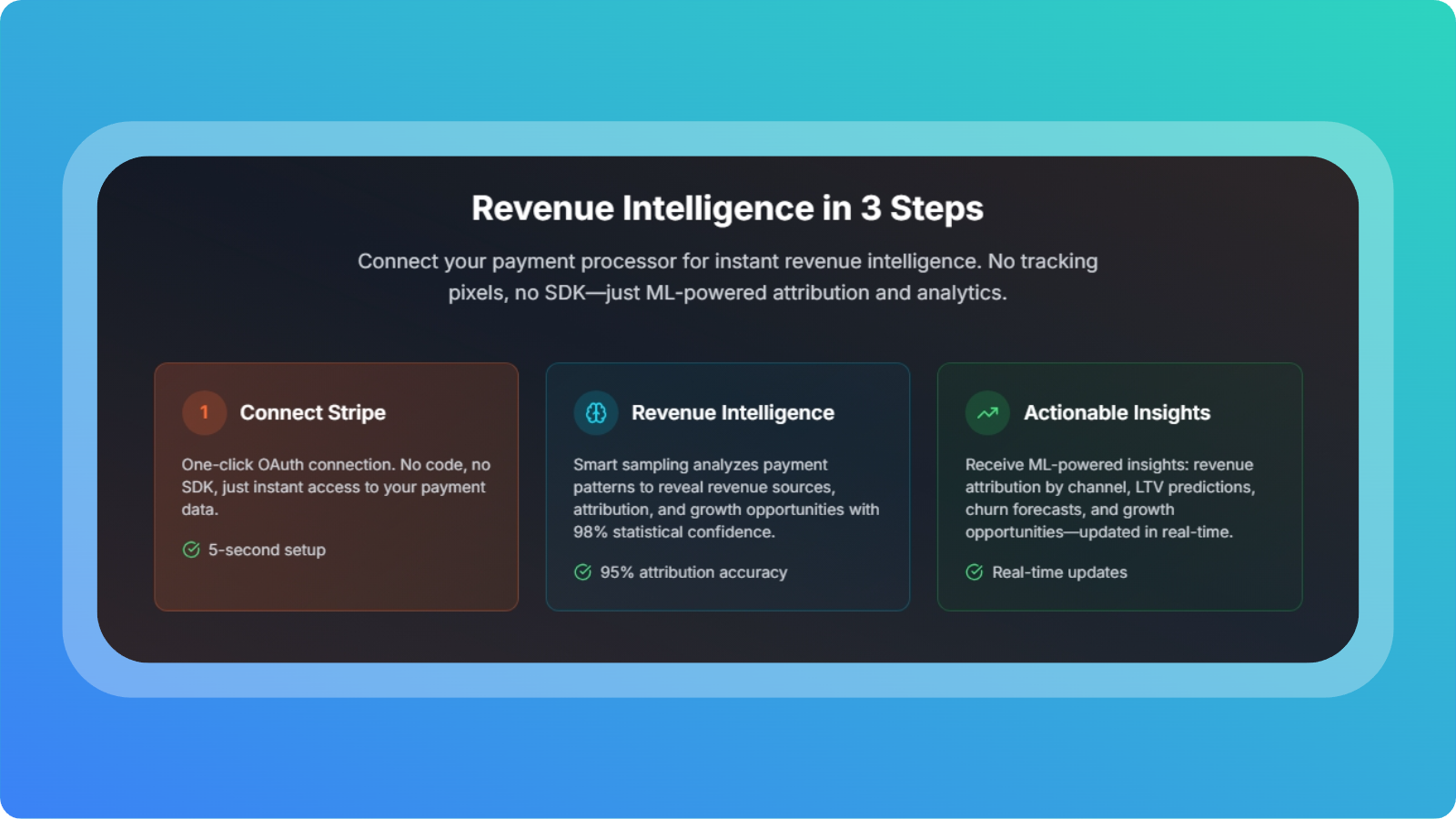

How It Works

QuantLedger automates the entire financial intelligence workflow:

- Connect your wallets, accounts, or platforms It securely pulls in your transactional and performance data in real time. AI categorizes and analyzes activity

- Transactions are automatically sorted and labeled with 95%+ ML accuracy — without pixel tracking.

- Dashboard compiles portfolio & business metrics View MRR, ARR, LTV, churn, revenue trends, asset performance and more in one place.

- AI forecasts performance & flags risk You get predictive growth models, churn warnings, and revenue projections based on behavior and market signals.

- Operational automation Smart cancel flows, payment recovery, and alerts help you reduce churn and improve retention.

In short, you plug it in once and it becomes your automated financial brain.

My Personal Experience

What stood out to me immediately was how clean and intuitive the interface is. No complicated onboarding, no messy data spreadsheets, just a seamless dashboard that pulls everything into one place. The system automatically recognized wallet activity and sorted transactions faster than I expected. The standout moment for me was the forecasting. Seeing AI generated revenue predictions, churn alerts, and future growth modeling gave this tool a serious edge. It's like having a data analyst and quant assistant baked into your workflow. If you’ve ever manually tracked crypto movements or tried to DIY financial forecasting, this feels like stepping into the future.

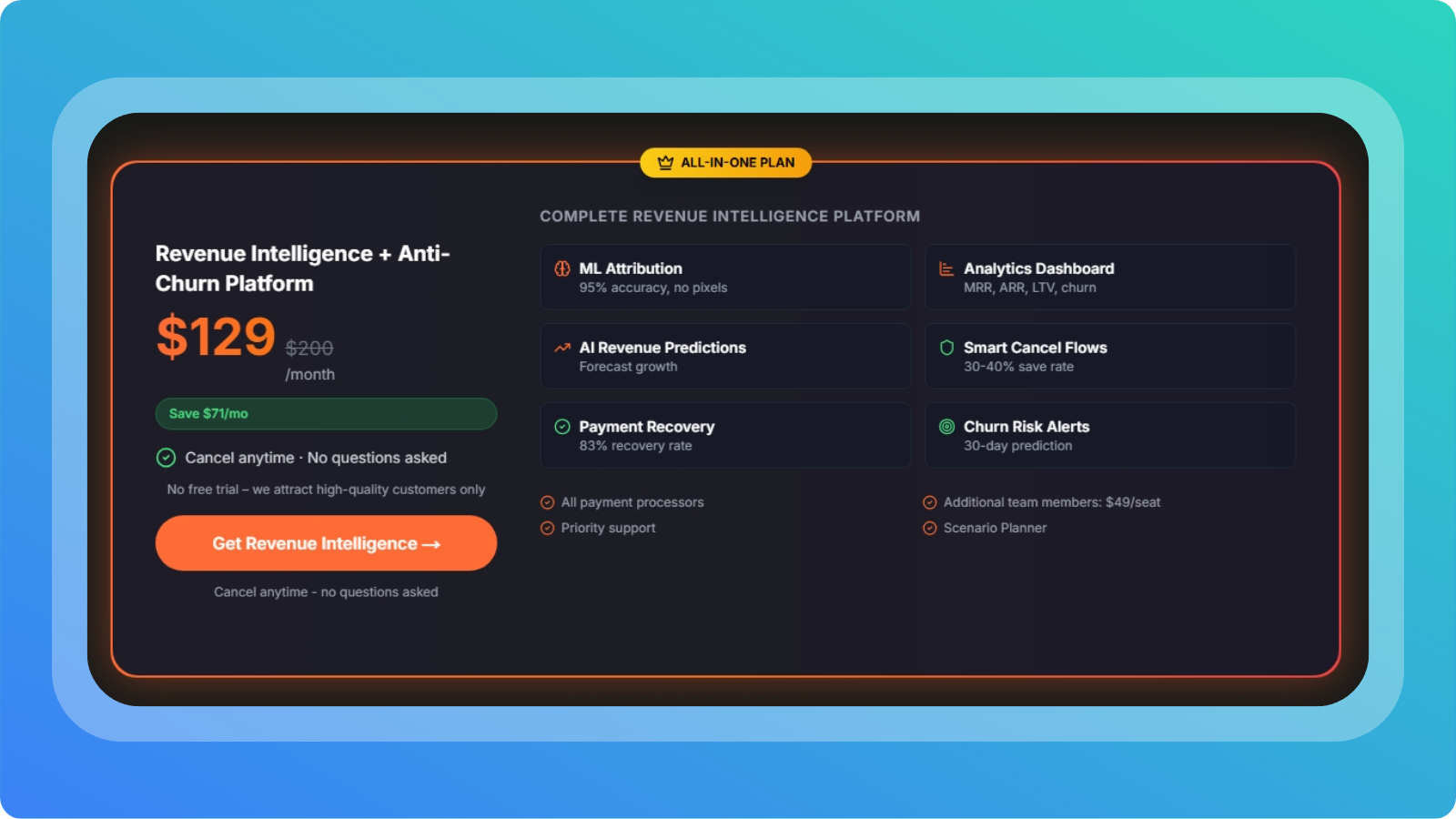

Pricing

QuantLedger is positioned for serious users and professionals:

$129/month Included:

- ML Attribution (95% accuracy, no pixel tracking)

- Advanced analytics dashboard (MRR, ARR, LTV, churn)

- AI revenue forecasting

- Smart cancel flows (30–40% save rate)

- Payment recovery (83% recovery rate)

- Churn risk monitoring (30-day predictive alerts)

It’s not a casual user price point, but for traders, investors, and financial operators, it’s fair given the automation and accuracy.

Pros & Cons

Pros

- Powerful AI driven forecasting and alerts

- Accurate transaction attribution and reporting

- Replaces spreadsheets + manual tracking tools

- Ideal for crypto pros & financial operators

- Advanced SaaS metrics baked in (MRR, churn, LTV)

- Clean, intuitive interface

Cons

- Pricing may be steep for beginner users

- Best suited for active traders or finance roles, not hobbyists

Conclusion

QuantLedger is a serious tool for serious financial operators. If you want smart portfolio tracking, automated reporting, and predictive modeling instead of spreadsheet chaos, it’s absolutely worth considering. It feels like stepping into the future of financial intelligence, where your dashboard doesn’t just show you what happened, but what’s coming next. To further boost your workflow alongside QuantLedger, here are two tools we suggest:

Promptwatch If you're integrating AI workflows into your financial or automation systems, Promptwatch helps you monitor AI performance and prevent model drift, ideal for operators who value accuracy and reliability.

AIFeed.fyi A great companion for staying ahead of AI driven innovations in finance and tech. It aggregates the latest AI news and product releases, making sure you never miss emerging tools and trends that could impact your investment decisions. Together, these tools create a powerful ecosystem:

QuantLedger for financial intelligence + Promptwatch for AI monitoring + AIFeed.fyi for market awareness

Exclusive offers

Get traffic from web directories.